Bridging the gap: The rise of the Solo GP

Every great company starts with a founder and a transformative ‘aha’ moment. Imagine if Uber's founder, Travis Kalanick, hadn't struggled to hail a cab in San Francisco, or if Dropbox's Drew Houston had remembered his USB drive. But did they succeed on vision alone?

Turning an ‘aha’ moment into a good idea and into a successful business requires capital. Founders have traditionally relied on a mix of personal savings, contributions from family or friends, and angel investing to get off the ground. But to drive significant growth, founders need venture capitalists investing large sums into the business.

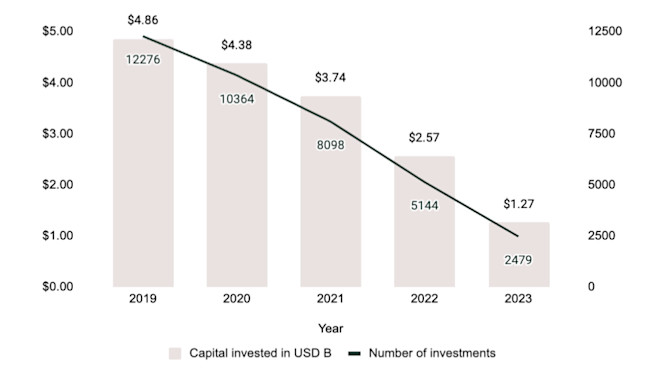

However, the graph below reveals a troubling trend: a steep decline in pre-seed investments. Even if it might seem that the pre-seed market is smoking hot, the data tells us only a few get the backing needed. This reduction at the very start of the investment funnel raises a critical question: if we are narrowing the entry point for new ventures, how can we expect to generate enough strong cohorts of companies at seed, series A and beyond?

Graph: Total capital invested and number of investments in pre-seed rounds in Europe. Source: Crunchbase data

In this challenging landscape, a new actor is emerging to bridge this gap: the solo GP. Being a lovely animal between angels and a VC, Solo GPs operate with independent funds and have a more personal approach, uniquely positioning them to support emerging ventures.

This piece will explore why Solo GPs are so special and showcase the most prominent solo GPs in Europe who are stepping up to fill and revitalising the lifeblood of a successful venture ecosystem: pre-seed funding.

Solo GP superpowers

Solo GPs have a unique blend of attributes that makes them extremely valuable to the startup ecosystem:

Let’s start with the basics: Money. Unlike angels, who often have limited funds, Solo GPs have raised capital from external investors, so they are willing (and often eager) to write larger checks into a company.

Solo GPs can also move quicker than VCs as teams tend to be smaller and processes are not as defined as in a VC firm. They can make fast investment decisions and provide swift support to their portfolio companies.

Most Solo GPs bring valuable experience from institutional investing. Their background equips them with a deep understanding of what is necessary for a startup to go into the next funding round and can help connect founders with other pre-seed/seed funds in their network.

Most VCs have an agnostic investment approach, while many solo GPs have a niche expertise and often specialise in a specific sector. This focus enables them to provide targeted support and connections, benefiting startups that need specific industry insights or resources.

Most importantly: Solo GPs are exceptional individuals. As the sole players in their ventures, they have no one else to rely on, making their personal brand and reputation extremely important. Without the shield of a shiny logo they uphold their promises and maintain high standards to continue being attractive partners in the competitive startup ecosystem.

Say hello to the new kids on the block

10 New Solo GPs

Founded in 2021 in London, UK

Run by Annelie Ajami

Focus on: B2B Companies in Europe

Ideal check-size: pre-/seed stage fund investing angel-size checks (~$2-500K)

One liner: Anamcara is reimagining the future of commerce by investing in companies that are leading the new wave of business technologies.

Founded in 2023 in Berlin, Germany

Run by Felix Plapperer

Focus on: All things B2B software (with a special knack SupplyChainTech)

Ideal check size: €100-400k on pre-seed, seed

Example investments: Timberhub, Ankar.ai, Comstruct.com

One liner: Why go big, when you can go booom? Booom puts the experience, network and advice of unicorn founders at the service of our portfolio -- delivering the maximum value per € invested from lift off to landing.

Founded in 2021 in London, UK

Run by Carmen Alfonso Rico (VC turned angel)

Focus: Generalist, founders are their investment thesis, “We back Killers with a heart”

Ideal check-size : $250k-$500k angel checks at first institutional round

One liner: Cocoa invests angel checks and brings VC expertise and network to support founders as their in-house VC, helping them hack the system from the inside

Founded in 2023, in London, UK

Run by Sarah Drinkwater

Focus on: Generalist but focuses on with companies on developers tools, crypto & AI infrastructure

Ideal check size: £100K–400K in pre-seed, seed

Example Investments: Ten investments made but none announced (one with Creandum)

One liner: Common Magic supports founders building products with community at their core across Europe and the US. Common Magic combines the speed and style of an angel investor with a global network and deep knowledge of how to build an authentic and effective community around your product.

Founded in 2024, in London, UK

Run by Sam Cash

Focus on: Critical industries (Sustainability, Sovereignty and Automation)

Ideal check-size: 250-500k

Example Investments: Three unannounced investments - additional one in “PLM for manufacturers”

One liner: The seed fund for founders building in critical industries

Founded in 2023 in London, UK

Run by Pietro Invernizzi

Focus on: No specified sector

Ideal check-size: £100-250K at early stage

Example investments: Omnea, Incident.io and Tern Group

One liner: Backed by 150 super angels, founders, operators and VCs, Firedrop invests in European founders as early as it gets.

Founded in 2021 in Berlin, Germany

Run by Declan Kelly

Focus on: B2B and consumer. They are investing across and between fintech, crypto, enterprise software, AI, marketplaces… and beyond.

Ideal check size: $50K and $100K in pre-seed & seed

One liner: Foreword invests in and supports companies throughout their initial chapters. Backed by an amazing community of founders, operators, and investors who want to help advance and scale the next generation of global technology companies.

Founded in 2023 in New York, USA

Run by Finn Murphy

Focus on: Topics in thesis include dev tools for non developers (vertical AI), local/edge AI and startups tackling the effects of demographic change in spaces like healthcare.

Ideal check-size: $500k-1.5m in pre-seed and seed

One liner: Nebular is an early stage venture capital fund based in New York City investing as a lead or co-lead at pre-seed and seed across the US and Europe. Nebular takes a thematic approach to categories looking for what’s next in software.

Founded in 2022 in Amsterdam, The Netherlands

Run by Anke Huiskes

Focus on: Infrastructure, tools and decentralised platforms that shape our work for the next decade

Ideal check size: $100-400k

Example investments: Roseman Labs, Tldraw, Emidat

One liner: NP-Hard Ventures invests in product-obsessed founders, creating the building blocks of tomorrow. They support early teams in Europe and the US who are building the infrastructure, tools, and decentralized platforms that simplify the way we work, by making technology more accessible and unlock creativity.

Founded in 2023 in Berlin, Germany

Run by Gloria Baeuerlein

Focus on: B2B Companies, European founders in Europe and the US

Ideal check size: €200-500k at pre-seed, €300-700k at seed

Example investments: No public investments yet

One liner: Puzzle partners with exceptional European pre-seed and seed founders who are building transformational B2B companies. Gloria is particularly interested in software that forms the backbone of companies' daily operations, either on the infrastructure or on the application level.

Run by Bogdan Iordache

Focus on: Generalist, high-velocity Eastern European founders with earned insights

Ideal check size: pre-seed, seed stage fund investing angel-size checks (~$200-700k)

Example investments: Veridion, Sera, Videowise, Trickest, Turneo

One liner: Underline Ventures partners at the earliest stages with Eastern European founders building high-growth startups with global ambitions.

Disclaimer: We decided to focus only on 10 new Solo GPs which we think are great. These are just some of the many solo GPs out there, so this is not a complete list.

Conclusion

Solo GPs are playing a pivotal role in addressing the pre-seed funding gap, essential for nurturing nascent technologies and business ideas. The impact of Solo GPs extends beyond financial investments; they can bring a wealth of expertise, networks, and a hands-on approach that is vital during the early stages of startup development.

As we highlighted the various new and promising Solo GPs across Europe, it's clear that the new kids arrived to stay and are here to create a more robust, diverse, and innovative startup culture.