Founder Compensation 2.0

We released our inaugural Founders’ Compensation survey twelve months ago in partnership with our friends at SLUSH.

As a community, we aim to build Europe’s most extensive database on early-stage founders’ compensation and help founders answer that all-important question: “How much should I pay myself?” This is something founders constantly ask us of our portfolio companies.

Around Series B, founders can access numerous benchmarking platforms, and check in with their peers and investors. In the earlier stages, especially Seed to Series B, we felt there was work to do to be more data-informed and fair; hence, we started this initiative for the founder community.

That was until last year’s report was released. We surveyed 500 founders across Europe from multiple sectors and different-sized startups, providing early-stage founders with a more informed, data-backed idea of what compensation is “normal” for their business and situation.

This year’s report continues that work with our friends from other Tier 1 VCs distributing the survey amongst their founder communities. Thank you again Accel, Index, Sequoia, Seedcamp, Insight, and LocalGlobe to name a few. We hope you find it useful. (Note: written Dec 2023, launched Feb 2024).

Key takeaways

Founder salaries are flat for the early stage, 2022 vs 2023.

Bonuses are on pause for all except bootstrapped companies.

UK salaries are still highest in Europe but down overall – and the same goes for fintech.

There remains a pay gap and representation problem.

Founder CCOs and CROs earn more than CEOs, with CROs being the best-paid function.

The VC view

For any VC-backed founders reading this report, the findings won’t come as a surprise, with most hopefully understanding that the current economic and investment environment is not one where it pays to overpay yourself.

Keeping funds within the company means swifter profitability, demonstrates discipline, an “all-in-it together” mentality, and an ability to focus on product and services rather than fundraising. The lower your expenses, the longer the run rate, and the better it is for you, your co-founders and your business.

In today’s economic and investment climate, this is more important than ever and one of many signals investors seek. Equally, you must have enough money to feel comfortable to live. While we hope this report can help with that, your investors and talent partners can also help you navigate the nuance of your particular situation, providing the necessary distance and context, sharing information about the space in which you and your business are operating, and what they’ve seen with other portfolio companies. They will help you determine what you and your business need to get through the next growth stage and successfully hit the milestones.

Michelle Coventry, Head of Talent

Our methodology

We launched the survey on 11 September 2023 and closed it on 31 October. We kept the survey open for longer this year to ensure we got as many respondents as possible and to ensure we utilised the networks of our friends in VC and their portfolio founders.

We closed the survey, we had responses from more than 700 from almost 50 cities across Europe. Combining that with last year’s report data now gives us over 1,000 data points that founders can use.

To build a complete picture, we asked them about:

Salaries, bonuses and equity

Location

Company size

Role

Gender

Total raised

Funding round

We then cleaned up the data:

All currencies were correct and standardised into Euros.

We combined the 47 cities into 8 regions: UK, Baltics, Nordics, DACH, CEE, Southern EU, Benelux and France.

Only complete or clear responses were included.

Then we got to work, analysing the responses and comparing them with last year’s findings to see what’s changed during the previous 12 months. All of that and more is in this report.

Cumulative and comparable

While the data we have asked for is the same as the inaugural version of this report, the respondents are, of course, all different. For example, while distribution across geographies was almost identical, the survey was viral amongst Pre-seed and Seed founders. In contrast, we had more responses from those at later-stage companies in 2022.

So, while they still represent a valid comparison, viewing it as a complete like-for-like should be done cautiously. For example, the number of Seed and Pre-Seed founders compared to last year would imply that salaries will skew lower when we don’t segment the data by funding stage.

First and foremost, it is an asset for the venture community to turn to when making one of the most nuanced early decisions you’ll have to make. Therefore, we recommend using this data alongside last year’s to build as complete a picture as possible.

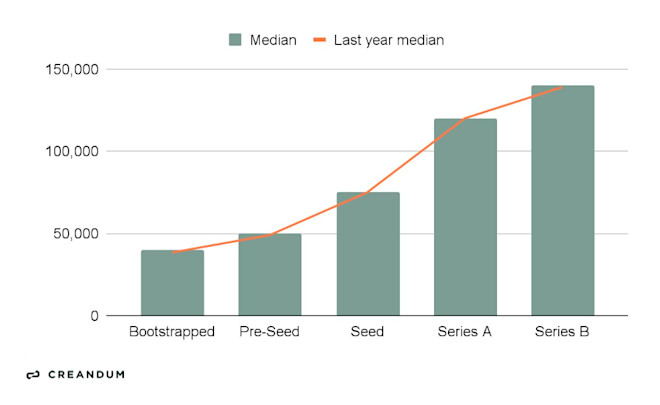

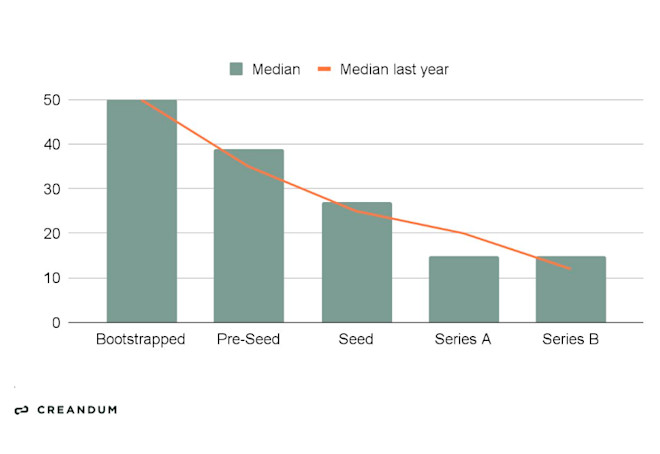

Salary by stage

Pay rises few and far between

Like last year, founder salaries increase stage by stage and generally top out at a little below €150k before Series B. The pressures of the current economic and funding environment won’t be news to anyone in the space. It seems likely that this stagnation indicates a more measured approach in response to those pressures, as does the general lack of salary growth among Seed+ founders.

Many founders would likely argue that with inflation biting across Europe, no pay rise equates to a net loss.

However, bootstrapped companies saw a 4% increase in median salary, the highest of the survey.

Pre-Seed founder salaries were the only other set to see an increase, albeit a small one of just 2%. Despite an overall decline in seed and pre-seed funding this year, several new European pre-seed focussed funds have been launched. There’s also a sense across the sector that the size of pre-seed funding rounds is increasing. In both cases, that additional capital would likely cause salaries to rise.

The most significant jump overall comes from Seed to Series A, where the median salary increases from around €70k to over €100k. As we said last year, once you’ve raised a couple of rounds and proved you can hit critical targets, you can start to compensate yourself more.

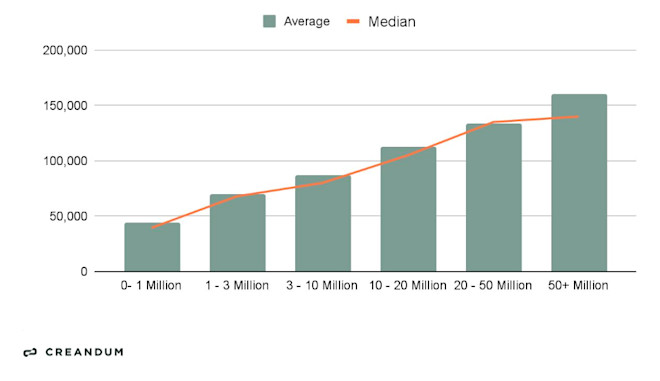

Salary by total funding

Salaries decelerate around €20m

As expected, average and median salaries increase as funding increases, with the largest jump in median salary coming once funding tops €1m, which leaps up by 72%. Funding beyond EUR 1m indicates the participation of institutional investment, which significantly impacts the salaries founders are able to pay themselves. From there, founder salaries steadily increase by between 20% and 30% for every additional €10m in funding. That is, until funding passes €20m, it stabilises until a company has raised €50m or more.

Last year, they were relatively stable from around the €10m to €50m mark.

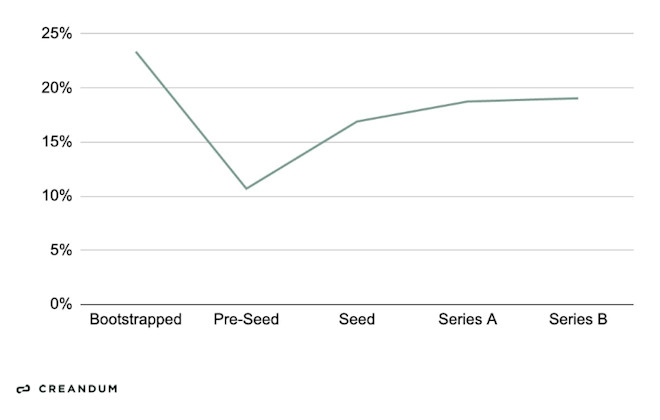

Bonus by stage

Bonuses at a minimum… unless you’re Bootstrapped

Only 25% of our respondents paid themselves a bonus, with the majority of those founders of Bootstrapped companies. Profits can give flexibility to founders building in this way. We see a clear divide between Bootstrapped and Venture-backed founder compensation regarding the Bonus mechanism. Whereas bonuses are quite common in Bootstrapped, at least at the early stages, this changes once institutional capital is injected to grow efficiently and sustainably on an accelerated growth path.

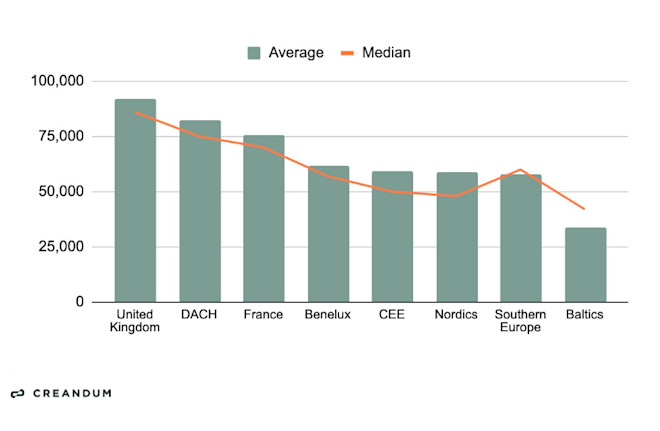

Salary by location

UK is leading, as inflation is biting across the continent

Founders had the highest median salary in the UK and the lowest in the Baltics. UK founders pay themselves almost €100k on average, while in the Baltics, pay is closer to €30k (it’s worth remembering, however, that the cost of living is considerably cheaper in the Baltics).

Having drawn data from the IMF to capture inflation across the regions in the same time period, we can state that salaries across stages remained broadly the same. With inflation increasing across all regions, this means a similar nominal salary in 2022 yields less purchasing power for founders. No surprises there but worth stating the work and staying mindful of what you need to live comfortably while you build.

Tip: When considering raises due to inflation, communicate a clear approach that takes into account your financial viability, performance, market rates, equity or bonuses and the time since the last review. Addressing this as a team rather than individually ensures fairness and consistency, maintaining morale, loyalty and productivity without being affected by variable cost of living adjustments.

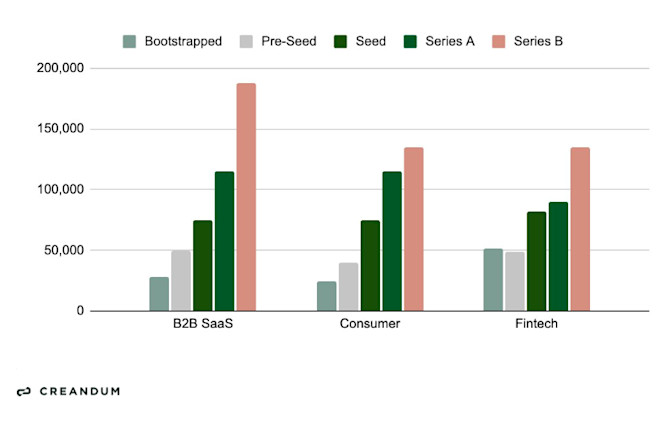

Salary by industry

Fintech salaries down, but sector still on top overall

It was a challenging year for fintechs. Total fintech funding and the number of fintech deals globally dropped from $63.2bn across 2,885 deals in H2'22 to $52.4 billion across 2,153 deals in H1'23. At the same time, high levels of inflation, rising interest rates, global conflicts, depressed valuations and exits. As a result, fintech founder salaries are down from last year. However, the sector continues to have the highest median salaries of the industry sectors we surveyed, despite both Consumer and B2B SaaS founders earning notably more from Series A onwards.

We should comment that the B2B SaaS Series B dataset is currently ‘statistically insignificant’. We’ll continue to improve this for you and with your help. Just two responses in this segment pulled up the median drastically.

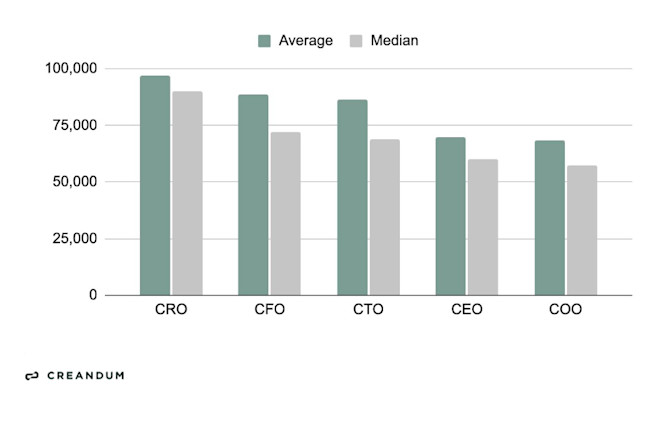

Salary by primary function

Founder CROs are worth their weight in gold

Our report has some difficult news for CEO founders: many founders who also serve as Chief Commercial Officers or Chief Revenue Officers are paid more. This trend is consistent with non-founder commercial leaders earning more than CEO founders.

Reflecting the trend in 2022 of moving away from the growth-at-all-costs mentality, a C-suite co-founder who can run a startup efficiently and grow steadily is gold dust in today's climate.

As a result, CROs receive the highest median salary at €90k, which is 25% higher than the next highly paid position.

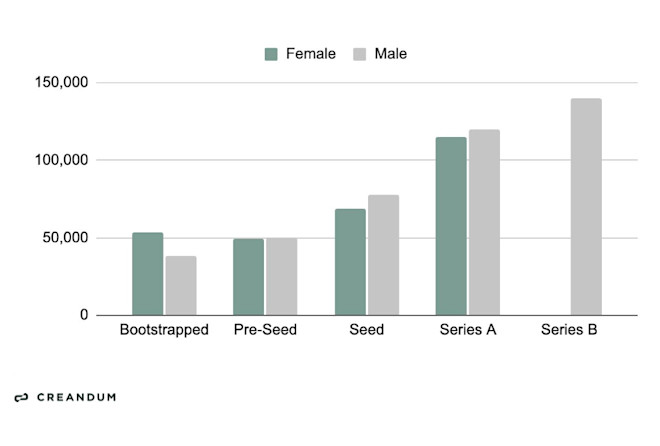

Salary by gender

Startups still have a pay gap and representation issue

Again, one of the most concerning insights wasn't just the pay gap between male and female founders but the need for more female founders to contribute to the survey. We had six times more responses from men than women (and could not easily find many female founders at Series B), which is only slightly under the estimated ratio of female to male startup founders in Europe (around 10% to 90%).

Regarding salary, it's at the earliest stages where there's the most significant median pay gap. While at Pre-Seed, the gap is just below 2%. This delta skyrockets at the Seed stage, where men receive 13% more.

Female founders are paid 29% more at Bootstrapped companies, although there are four times more data points for men than women at this stage, so it is hard to know if that number is truly representative of the wider industry. We commit to expanding representation across all stages in 2024.

Equity share by stage

No surprises here – but lessons that warrant repeating

Unsurprisingly, a founder's share of equity decreases as the startup matures. The decrease in equity is steepest from the Bootstrapped to Series A stages when institutional capital is introduced.

While this won't come as a shock, it's a welcome reminder:

Founders, equity is your ultimate payday when your shares liquidate. It's essential that from day one, you understand the dramatic impact of the number of co-founders you start with as over rounds raised, the dilution factor exponentially increases by this number.

Two or three founders seem to be the norm, although Ali Tamaseb, a partner at DCVC who analysed more than 200 unicorns between 2005 and 2018, discovered that a solo founder set up 20% of all billion-dollar startups.

Two founders versus six co-founders is a very different journey. It has a material impact on your wealth creation. You're already more diluted before you even get to Series A, and your freedom of movement is more restricted throughout the life of your company. Also, it can take a lot of work to move as fast with several people at the helm.

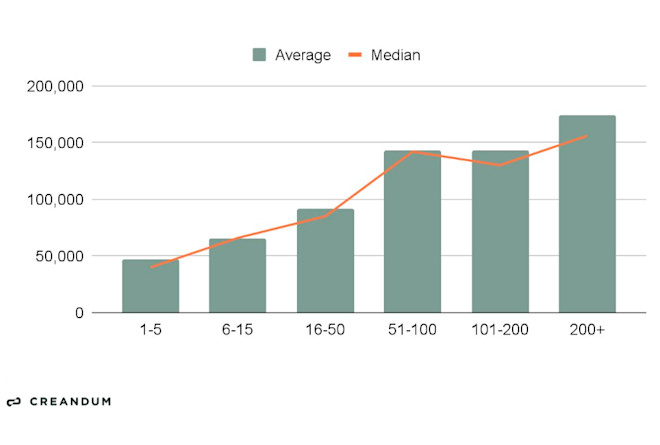

Salary by number of Full Time Employees (FTEs)

More FTEs, more money

As the company grows and hires more FTEs, the founders' salary also increases, reflecting the size of the job at hand and the company's growth. The most significant jump comes after a company hits around 50 FTEs before jumping significantly again at the 200+ FTE mark.

For the latter increase, one can assume that many of the companies with over 200 employees will be post Series B, where founders will have been in the job long enough for their shares to have vested, while the company should have reached product market fit, begun scaling and de-risked the business to a certain extent. At that point, founders transition into a traditional CEO role (or, as we've seen, another C-Suite position) and begin to command a salary that the CEO of a 200-person company would expect. For some founders, this point may even come around the 50+ FTE mark, hence the initial jump.

Nothing has changed and everything has changed

In the startup world, 12 months can be both a very long time and simultaneously no time at all; the findings of this report exemplify that, picking up where last year left off. Salaries continue to rise by round, UK and Fintech founders are still the highest paid, the number of co-founders continues to have the most significant impact on equity, and, sadly, women remain underpaid and underrepresented in tech.

And yet, when you look beyond the headline stats, it's clear that founders face a very different environment—forcing them to make tough decisions that will likely leave them out of pocket. To grow sustainably and attract further investment, for many, efficiency is the name of the game, at least for now.

Of course, there is no 'one approach' that all founders should take. These findings aim for us all to be more data-informed, a benchmark and guide, rather than a rulebook. Founders, use them to spark conversations with your investors and talent partners. They can act as your sounding board and help fight your corner, getting what's right for you and your business.

This project remains a work in progress and is open all year. It's your data we are guardians of, and hope informs and guides as a go-to resource for the founders, investors and board members in the VC Tech Community when thinking about their compensation in the data-poor early stages. Doing that means making adjustments each year, iterating and improving so it's as helpful as can be.

And so, watch this space! Feel free to share comments or ask any specific questions at talent@creandum.com. Onwards!

Your Compensation Calculator

Let's demystify Founder Compensation - join & contribute to the Compensation Calculator! Your anonymous data can set new standards from Bootstrapped to Series B+. There’s no simple way, but together, we can turn compensation challenges into data-driven clarity.

Be part of the movement. Empower decisions and unite our European founder community. Act. Contribute. Transform. Let’s go!